I placed my first sports bet at the age of 12.

As fate would have it, it was a winner (a three-match multiple, maybe a few quid of profit).

So you’d think over 20 years later I would have figured out this betting thing?

Not really.

It took me over 20 years to internalize my mistakes and start consciously working on them.

Finally, last year I started making money stopped losing consistently.

In this post, I’ll share:

Why it took me so long to figure out I was a compulsive gambler

What a trading edge is and why internalizing this concept is key

How I found my edge

How you can find your edge and stop being an expensive gambler

How I deceived myself into thinking I was ‘a trader’

I vividly and fondly remember the year 2002. It was the year the FIFA World Cup was played in Japan and South Korea.

Every other day, I was biking the three kilometers from my parent’s house to the little office supply shop selling lottery tickets and sports betting slips. The last kilometer was uphill. But that sure didn’t stop me.

A year earlier, my dad had taken me to the bet shop for the first time. Thanks dad for turning me into a lifelong gambling addict speculator:

Signed up to Betfair even before turning 18, where I compulsively tried to beat the tennis and football markets.

Ran up my bankroll to 200k in my mid-20s (some skill, mostly luck), then decided I was “going pro.” I was looking for a job a year later.

Concluded sports is impossible to turn a profit with but still didn’t quit cold turkey until I discovered crypto.

Made a windfall betting the 2020 election but lost it all in 2021 with crypto. It turns out you need to learn this stuff.

Stayed away from both sports and crypto (mostly) until the beginning of 2024.

Ran up my bankroll again in 2024, past the previous peak. I learned a lot on the way, but still making too many mistakes.

All this time, I was a(n expensive) gambler. But I want to become a trader.

So, how do you know whether you’re trading or gambling?

Here’s what Claude has to say:

Yup, I was a gambler, not a trader:

I did not have proper risk management, develop my skills in a systematic way, or focus on the long term.

I did do some research, try to develop an edge, and utilize data and analytics (with moderate success).

Finding good ideas or picking winners was never my problem. Managing risk and designing and refining processes are.

That’s why I ran six figures down to practically zero twice. The first part is crucial and can be your edge. But it won’t work without the latter part.

When did the penny drop on this?

There was no single aha moment. No one massive L I took that switched on the lightbulb. It was — and is — a matter of touching the stove so many times, getting burned so often that you realize you’ll either keep touching it — and have no hand left at some point — or you figure out how to turn down the heat.

I don’t yet know how to cook but I damn well am figuring out how to put on a glove before touching the stove.

What is a trading edge?

A trading edge, in my understanding, is the advantage you have over the market that allows you to, on average, turn a profit.

You may lose or win any individual trade, but because you have an edge, you turn a profit in the long run.

IMO, there are four types of edges:

Capital

Technology

Information

Synthesis

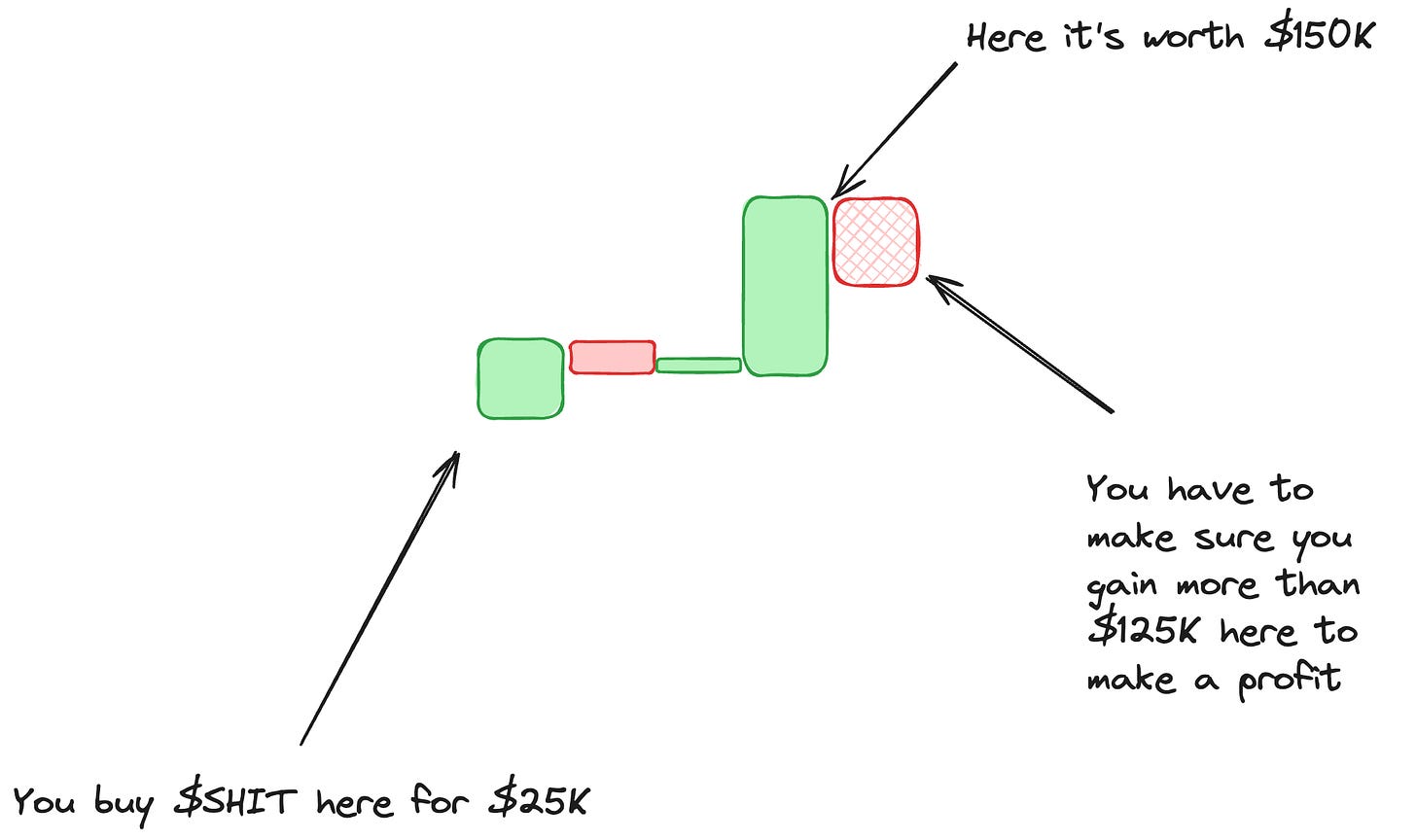

Capital

Capital is an edge if you can manipulate a market to shift the odds in your favour.

Imagine a shitcoin $SHIT with a valuation of $10,000 and yourself with a bankroll of $1 million.

Let’s further assume you have reason to believe that by inflating the price, you will be able to lure in exit liquidity other traders that want to bet on the trending coin.

You start consistently buying $SHIT and inflate the price beyond its “fair value.” Other traders rush in, trading volume increases, price moons, and your $SHIT, acquired early at a low price, is now worth a lambo.

You dump and count your profits.

Here’s where your edge is:

Having enough capital to be able to manipulate the price and withstand early losses from $SHIT not increasing in value.

Being able to cash out because $SHIT is liquid enough after increasing in value.

This is essentially the role of a market maker. They do not only buy $SHIT but increase its volume and thus its liquidity.

Little capital can also be an advantage but it is not an edge in itself.

Say you’re able to consistently turn a profit trading Bitcoin and your trade size is too small to impact the market. Your small size is an advantage but not the reason you’re making money. If anything, you’d probably want to bet more if you could

Technology

Technology as an edge often (but not exclusively) relates to speed.

Examples are high-frequency trading algorithms or connection speed.

Another example, not related to speed, is miner-extractable value in crypto or using artificial intelligence (in ways that are beyond my understanding).

The basic principle: better technology allows you to execute faster trades or acquire assets at more favorable prices.

Information/Persuasion

Information is a simple edge: you know something others do not and can arbitrage the difference (= you buy low and sell at a higher price when everyone has the information).

Colloquially, this is also known as “dumping on others.”

Informational arbitrage is probably the best edge. In fact, nowadays, disinformation can also be an edge. Persuade others to believe false information and you can manipulate the market in your favor.

Influencers persuading their exit liquidity audience to buy a token or Q-Anon retards consumers of alternative information believing an election can be won after voting has closed are examples where persuasion and (dis)information create edges.

Synthesis

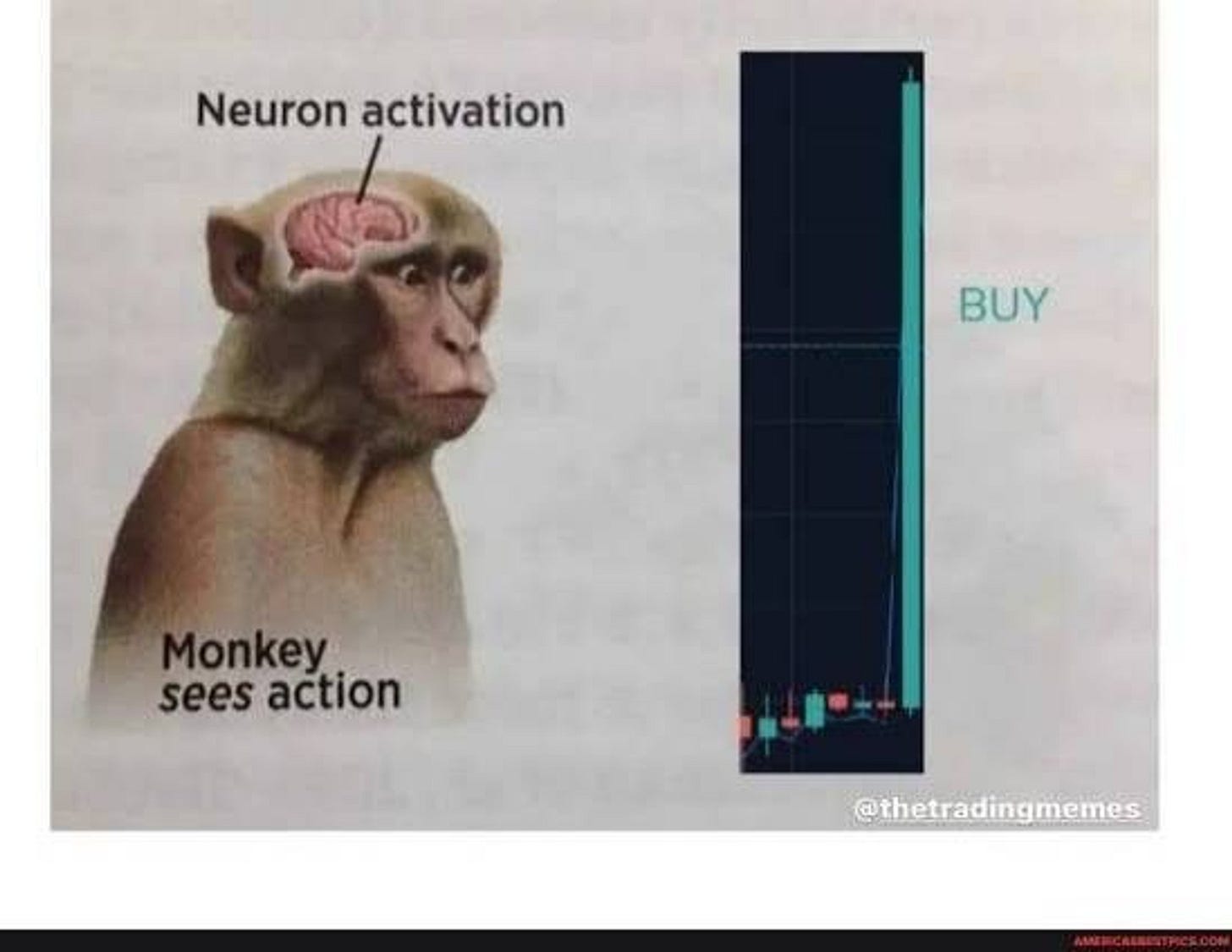

Synthesis is IMO the most common edge for retail traders (and not only).

We all think we can read the market better than the next idiot. But we don't like to admit that our emotions and biases play tricks on us.

The best synthesis edge is a form of informational arbitrage, i.e. pattern recognition. If you’re good at "reading a situation" (identifying patterns), you can generate an insight others do not have and capitalize on it.

Even the so-called ‘smart money’ (institutional money) often operates with synthesis alone (read: they’re using best guesses). I have seen enough false predictions from ‘institutional money’ to conclude that most of the time, their is capital (read: market manipulation), not pattern recognition.

All well and good, but how do you find your edge?

You call this an edge? THIS is an edge

One of the key concepts every good crypto trader needs to internalize is submitting to the narrative. Crypto has no fundamentals but only trades on narratives. Therefore, it doesn’t matter whether something is “true.” It only matters whether people think it is.

That’s how I think about my trading edge. Maybe it’s all imaginary bullshit. But it’s a framework that works for me and that’s what counts.

Here’s what I distilled as my edge:

Mindfulness: Things will take longer than I expect but I will eventually achieve my goal. Be at peace with the friction.

Vision: I understand market participants better than they understand themselves. I use this vision to plan in advance what my move will be after the market has made its.

Intuition: My ability to distill the signal from the noise and realize what is the relevant information from different sources allows me to generate insight.

Now you’ll think: this is an edge? Manifestions? Seriously?

You may not like it, but this is what my peak performance looks like. These are the three pillars to more specific guidelines I have set for myself. For instance, the first looks like this:

Patience: Don’t rush into positions. If you have to make a decision in a split second, it’s probably not worth making. Do not enter positions impulsively UNLESS you have a clear fundamental invalidation. Do not switch bias on a whim. If your thesis is clear, your conviction will follow.

I have five of these with clear directions what I’m looking for in a trade. In other words, the Do’s and Don’t’s of a trade. A checklist if you want.

I do have setups and markets I prefer. For instance, I’m not a 100x moonshot chaser — I prefer to find a 100% gain with size. But these are my unique preferences and sharing them with you won’t help you. Showing you how I found them might.

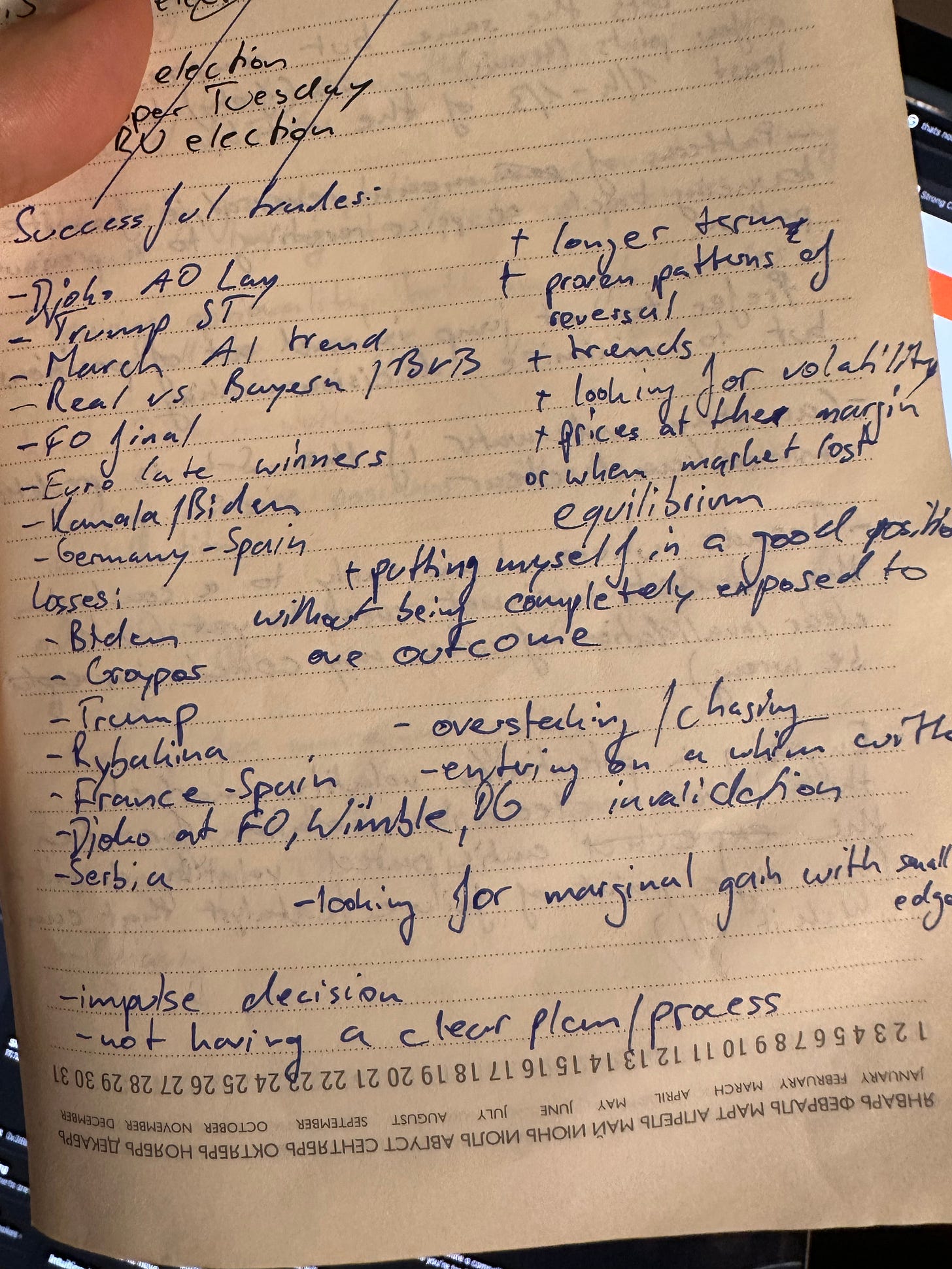

I came up with this the same as any good system or product is designed: using trial and error.

I started 2024 from almost zero and traded for a few months without clear direction. It was going pretty well, but I was still making the same mistakes of old way too often.

A few months in, I sat down and tried identifying the patterns in the trades (or bets) that worked and those that didn’t. Based on those I came up with the first set of guidelines/checklist to follow.

This helped me cutting out the worst and most brutal mistakes, such as chasing losses, the worst impulse decisions, etc. Basic stuff really, but I honestly doubt most traders do even that bit of work. Anyway, it showed in my results.

Recently, I repeated this process for the latter half of the year. The do’s and don’t’s barely changed. My successes and failures were still largely following the same patterns. It was just a matter of following my own guidelines more strictly.

That’s why I distilled them into a manifesto with a checklist I can follow in my trade selection. It’s the first page of my trading journal — something I tried starting (and quit) several times. 12 days into 2025, I’m still at it.

How to find your edge

If I had to distill my process into a $997 video course $47 e-book framework you can follow, here’s how it would look like:

Set aside a sum of money you can lose with trading. Think about how much money would hurt losing, then take half of that. You’ll probably still be pissed off once it’s gone and it will be if you’re a beginner (why else would you be reading this?).

Start trading. You don’t need a system or an idea of what you’re doing. In fact, I’d argue you don’t even need risk management at the beginning. Even if you do have risk management, it’ll most likely go out of the window at some point. Just do stuff.

You can and should keep track of what you’re doing and why. A post mortem several months after, like I did, isn’t ideal because you emotionally remove yourself from the situation. Your trading journal is really your dirty little diary that you confess all your worst sins to, especially at the beginning.

Once you have a sufficiently big sample size of winners and losers (try not to lose it all too quickly), find the patterns. Which trades worked and why? Which didn’t? Which trades did you feel comfortable with? Which did stress you out? Why? It’s all about drilling down on your unique preferences.

Compile your manifesto. Once you found what worked and what didn’t, do more of the former and less of the latter. It’s simple but not easy. That’s called reinforcement learning and the market will give you direct and swift feedback on whether you’re on the right track or not.

What do I do now?

First, understand nothing of the above is investment or life advice. As you can tell, I don’t know what I’m doing, so DYOR.

Next, subscribe to my Substack to learn alongside me how to improve your decision-making:

Finally, thanks for reading if you made it this far!